Condo Insurance in and around Jackson

Unlock great condo insurance in Jackson

Quality coverage for your condo and belongings inside

- Jackson

- Madison

- Ridgeland

- Brandon

- Pearl

- Columbus

- Tupelo

- Hattiesburg

- Memphis

- Nashville

- Birmingham

- Baton Rouge

- Shreveport

- New Orleans

Welcome Home, Condo Owners

Because your condominium is so special to you, it makes sense to want to protect against the unexpected, which could include situations or damage due to vandalism or lightning. That's why State Farm offers coverage options that may be able to help protect your unit and personal property inside.

Unlock great condo insurance in Jackson

Quality coverage for your condo and belongings inside

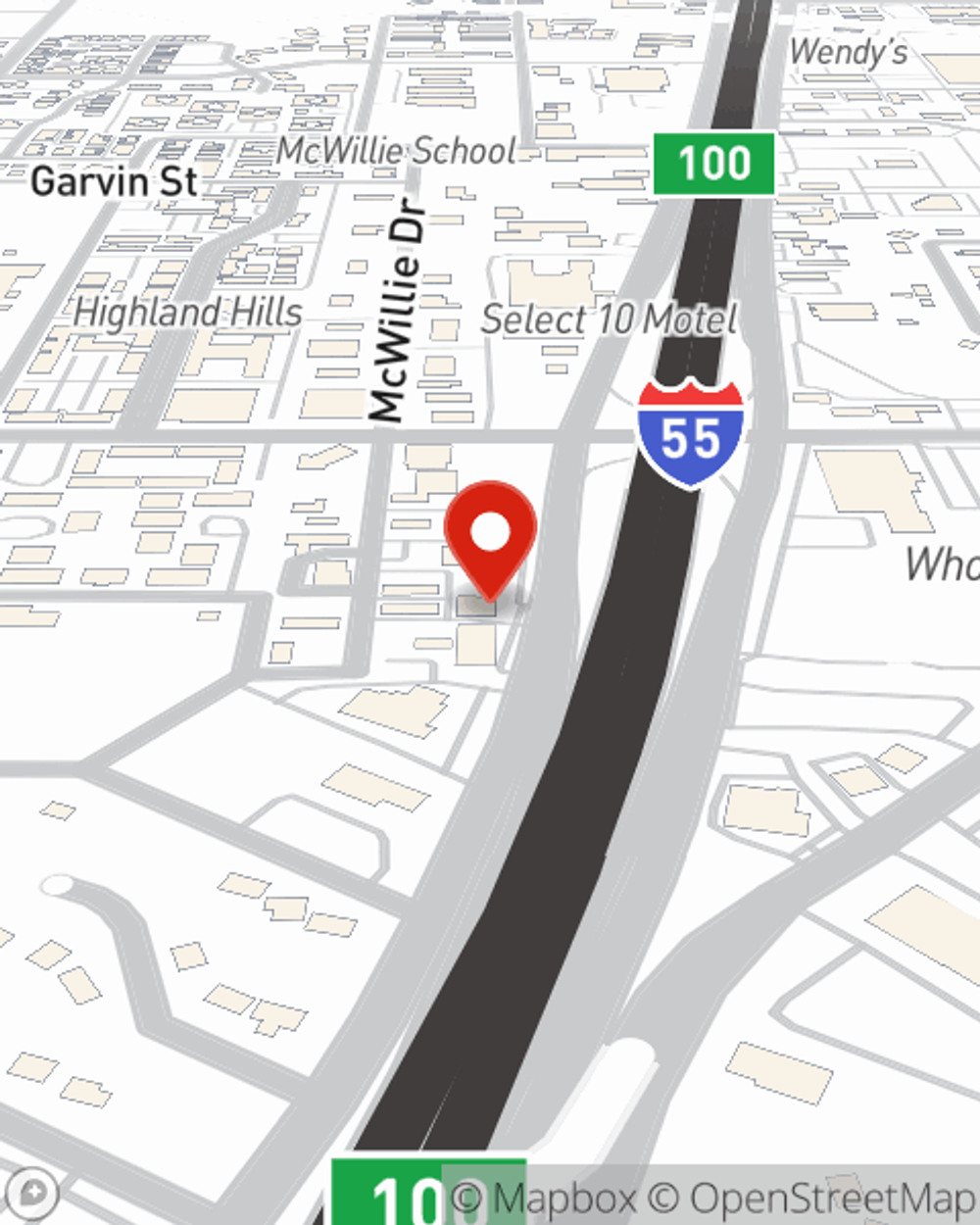

Agent John Lucas, At Your Service

You can sleep soundly with State Farm's Condo Unitowners Insurance knowing you are prepared for the unexpected with terrific coverage that's right for you. State Farm agent John Lucas can help you explore all the options, from liability, possible discounts to bundling.

Visit State Farm Agent John Lucas today to learn more about how one of the well known names for condo unitowners insurance can help protect your townhome here in Jackson, MS.

Have More Questions About Condo Unitowners Insurance?

Call John at (601) 812-6310 or visit our FAQ page.

Simple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

Plumbing maintenance tips

Plumbing maintenance tips

Home plumbing problems can cause major damage. Performing a home plumbing checkup regularly can help to avoid plumbing issues. Read more tips.

Simple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

Plumbing maintenance tips

Plumbing maintenance tips

Home plumbing problems can cause major damage. Performing a home plumbing checkup regularly can help to avoid plumbing issues. Read more tips.